The uninsured rate has declined substantially since provisions of the Patient Protection and Affordable Care Act (ACA) came into effect. Nevertheless, many individuals continue to experience instability in insurance coverage. Transitions between different insurance plans, as well as between insured and uninsured status, are often referred to as “insurance churning.”

The uninsured rate has declined substantially since provisions of the Patient Protection and Affordable Care Act (ACA) came into effect. Nevertheless, many individuals continue to experience instability in insurance coverage. Transitions between different insurance plans, as well as between insured and uninsured status, are often referred to as “insurance churning.”

The causes of insurance churning vary. Changes in job status may result in loss of coverage or transition to a new insurance plan. Eligibility for Medicaid or plans with Marketplace subsidies may change based on changes in family composition or fluctuations in income. Nationally, three to five percent of members are dropped each month by health plans offered on the Health Insurance Exchange due to non-payment of premiums.

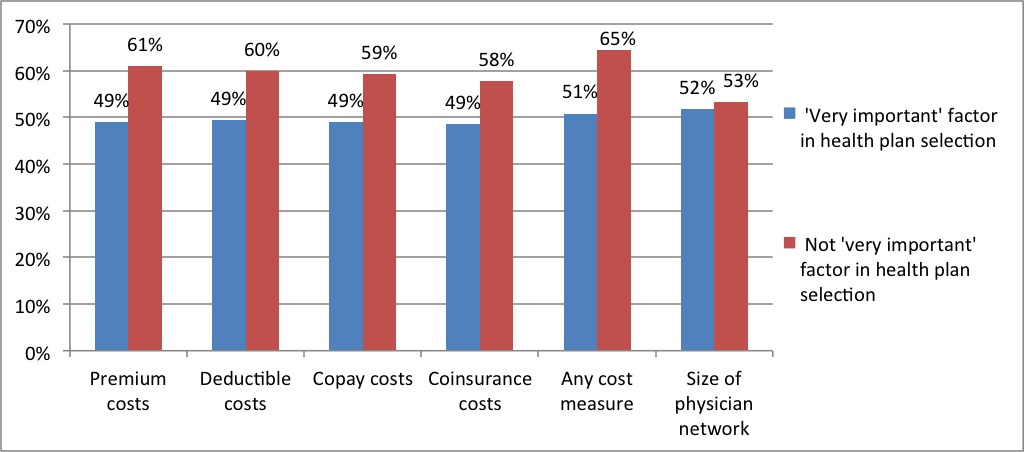

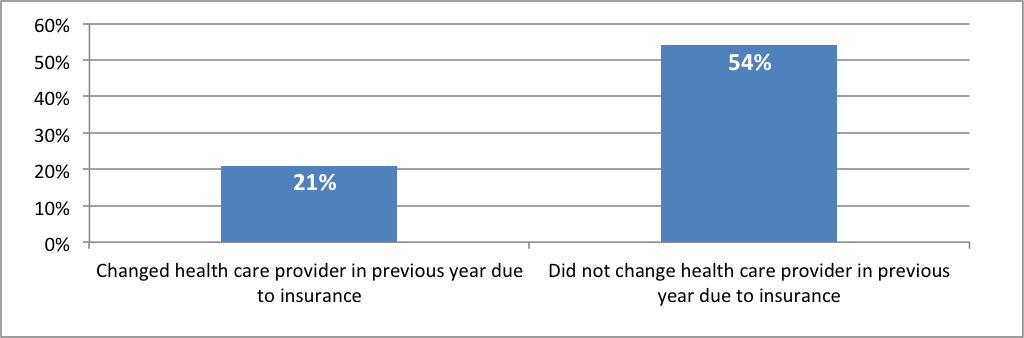

Insurance churning can affect quality, cost, and continuity of care. Individuals may avoid seeking health care when they need it during gaps in insurance coverage. Even if consumers maintain continuous coverage while transitioning between different insurance plans, they may find that their regular health care providers do not accept their new insurance plan. In addition, when they change health plans, research shows that medication compliance is often disrupted. These and other churning-related problems tend to be exacerbated by uncertainty about what new co-pays or deductibles might be as well as by known increased costs associated with new insurance plans.

A recent study found no evidence of significant increases or decreases in broader indicators of insurance churning since the introduction of the ACA in three states (Texas, Kentucky, and Arkansas). Under the new administration, depending on which provisions of the ACA are repealed, replaced, defunded, or retained in the coming years and how these changes are implemented, rates of insurance churning could change dramatically.

Between 2013 and 2015, data from the Census Bureau show that the proportion of Michiganders who reported no source of health insurance declined by five percentage points—from 11 percent to 6 percent. Using data from the Center for Health and Research Transformation’s Cover Michigan Survey, this brief explores consumer experiences with insurance churning and access to care within the state of Michigan for approximately a one-year period in 2014–2015.

Key findings include:

- Medicaid recipients had the most instability in their coverage status of all respondents to the survey. Medicaid recipients were also seven times more likely to have experienced a temporary uninsured period in the past year compared to respondents with employer-sponsored or individual coverage.

- Those with individually purchased coverage in 2014 were the most likely to switch to a different type of coverage in 2015. Among respondents with an individually purchased plan in 2014, less than half reenrolled in the same plan in 2015, and nearly a third transitioned to Medicare or to an employer-sponsored plan in 2015.

- Those with employer-sponsored coverage experienced the least amount of churning compared to respondents with other coverage. Ninety-four percent of respondents with employer-sponsored coverage remained continuously insured from 2014 to 2015.

Publicly-reported hospital rankings are released annually and are widely publicized by both the sponsors of the rankings and hospitals that are highly ranked as indicators of hospital quality or safety. Meant to be a useful way for consumers to assess hospital quality, these ranking systems produce inconsistent, contradictory, and confusing results, as some hospitals are highly ranked in some systems but not in others.

Publicly-reported hospital rankings are released annually and are widely publicized by both the sponsors of the rankings and hospitals that are highly ranked as indicators of hospital quality or safety. Meant to be a useful way for consumers to assess hospital quality, these ranking systems produce inconsistent, contradictory, and confusing results, as some hospitals are highly ranked in some systems but not in others.

Since its passage in 2010, the Affordable Care Act (ACA) has introduced a series of health care financing and delivery reforms to expand coverage, invest in health care infrastructure, and implement changes to improve quality and costs. In 2014, the ACA’s coverage expansion began in Michigan through the launches of the health insurance marketplaces on January 1 and the Healthy Michigan Plan (Michigan’s Medicaid expansion program) on April 1. These programs have contributed to sharp reductions in the number of uninsured Michigan residents.

Since its passage in 2010, the Affordable Care Act (ACA) has introduced a series of health care financing and delivery reforms to expand coverage, invest in health care infrastructure, and implement changes to improve quality and costs. In 2014, the ACA’s coverage expansion began in Michigan through the launches of the health insurance marketplaces on January 1 and the Healthy Michigan Plan (Michigan’s Medicaid expansion program) on April 1. These programs have contributed to sharp reductions in the number of uninsured Michigan residents.

These figures describe the health insurance coverage changes that occurred during the 2014 calendar year, the first year of the Affordable Care Act’s (ACA) coverage expansion provisions. These provisions included the launch of the health insurance marketplaces in all states and the optional Medicaid expansion adopted by 26 states and the District of Columbia in 2014.

These figures describe the health insurance coverage changes that occurred during the 2014 calendar year, the first year of the Affordable Care Act’s (ACA) coverage expansion provisions. These provisions included the launch of the health insurance marketplaces in all states and the optional Medicaid expansion adopted by 26 states and the District of Columbia in 2014.

2014 marked the launch of the health insurance marketplaces and Medicaid expansion under the Affordable Care Act (ACA). These programs expanded health insurance coverage to many previously uninsured residents, resulting in sharp decreases in the uninsured rate both nationwide and in Michigan. Expanded access to health insurance can benefit health care providers, such as hospitals, financially through reducing their uncompensated care burden.

2014 marked the launch of the health insurance marketplaces and Medicaid expansion under the Affordable Care Act (ACA). These programs expanded health insurance coverage to many previously uninsured residents, resulting in sharp decreases in the uninsured rate both nationwide and in Michigan. Expanded access to health insurance can benefit health care providers, such as hospitals, financially through reducing their uncompensated care burden.

The Patient Protection and Affordable Care Act of 2010 (ACA) contains several provisions that directly affect employers and impact the employer-sponsored health insurance (ESI) system through which the majority of Americans receive coverage. While some experts predicted declines of 4.5 percent or more in employer-sponsored coverage from 2010 to 2016, ESI remained stable in Michigan in 2014, with the continuation of many notable trends.

The Patient Protection and Affordable Care Act of 2010 (ACA) contains several provisions that directly affect employers and impact the employer-sponsored health insurance (ESI) system through which the majority of Americans receive coverage. While some experts predicted declines of 4.5 percent or more in employer-sponsored coverage from 2010 to 2016, ESI remained stable in Michigan in 2014, with the continuation of many notable trends.

The third open enrollment period for individual coverage on Michigan’s health insurance marketplace began on November 1, 2015, and will continue until January 31, 2016.

The third open enrollment period for individual coverage on Michigan’s health insurance marketplace began on November 1, 2015, and will continue until January 31, 2016.